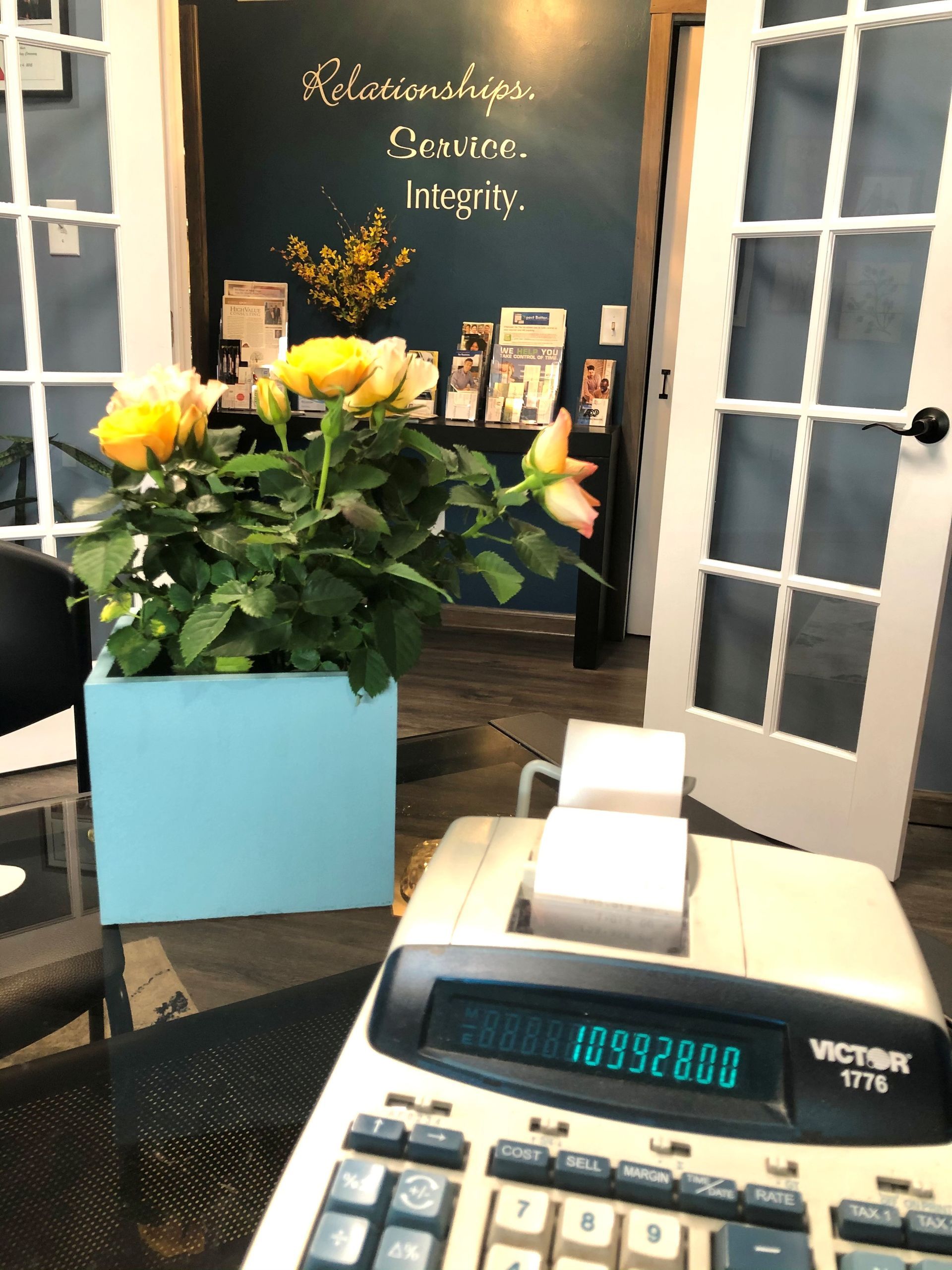

Congratulations New Parents!

Congratulations to welcoming another new bundle of joy into the world!

I f you haven't realized already, kids are expensive! Fortunately, there are several tax breaks for new parents.

1 - Child Tax Credit:

Partially REFUNDABLE CREDIT available to parents with dependent children under age 17. The CTC is $2,000 for each qualifying child if your modified adjusted gross income (MAGI) is under $400,000 for joint filers.

2 - Dependent Care Credit:

This credit is for costs of caring for children under 13 yo so you and your spouse can work. The maximum credit is $600 for 1 child and $1,200 for 2 or more children.

3 - Adoption Credit:

For 2023, parents can claim a maximum credit of $15,95 for qualified expenses incurred to adopt an eligible child. The credit begins to phase out for taxpayers with MAGI above $239,230 and is zero if you reach $279,230.

4 - Higher Education Credits:

The maximum annual American Opportunity Tax Credit of $2,500 is available for up to the first 4 years of study for each student. ------The maximum Lifetime Learning Credit (LLC) is $2,000. The LLC applies to each taxpayer (not each student) but is available for all years of study - not just the first 4 years.------------Each credit is subject to phase-out based on MAGI.